The Market’s Most Expensive Asset Is Certainty

By the end of 2025, markets stopped rewarding conviction. Valuations remained elevated. Liquidity thinned. Forward visibility collapsed. What used to look like “confidence” increasingly resembled risk mispricing.

This is what late-cycle environments do best: they make nearly everything look investable — right until the math changes.

In these moments, smart capital doesn’t rush into new stories. It pauses.

This explains the record liquidity levels at the top of the food chain described above. It’s not a defensive reflex. It’s a refusal to accept asymmetry where the downside is known, and the upside relies purely on hope.

That is the backdrop as 2026 begins. Not fear. Not euphoria. But a growing awareness that financial gravity has returned.

Why Gold Looks Different in 2026

Gold isn’t rising because of panic. It’s rising because of structure.

Over the past several weeks:

Precious metals surged — then consolidated, not collapsed

Treasury yields stabilized, but stopped responding to growth narratives

Real assets quietly outperformed speculative themes

That pattern usually appears before a broader allocation shift. And major institutions have noticed.

Several global banks now project gold prices north of $4,500–$5,000 per ounce in 2026 — not on hype, but on debt dynamics, fiscal pressure, and reserve diversification.

But here’s where it gets interesting:

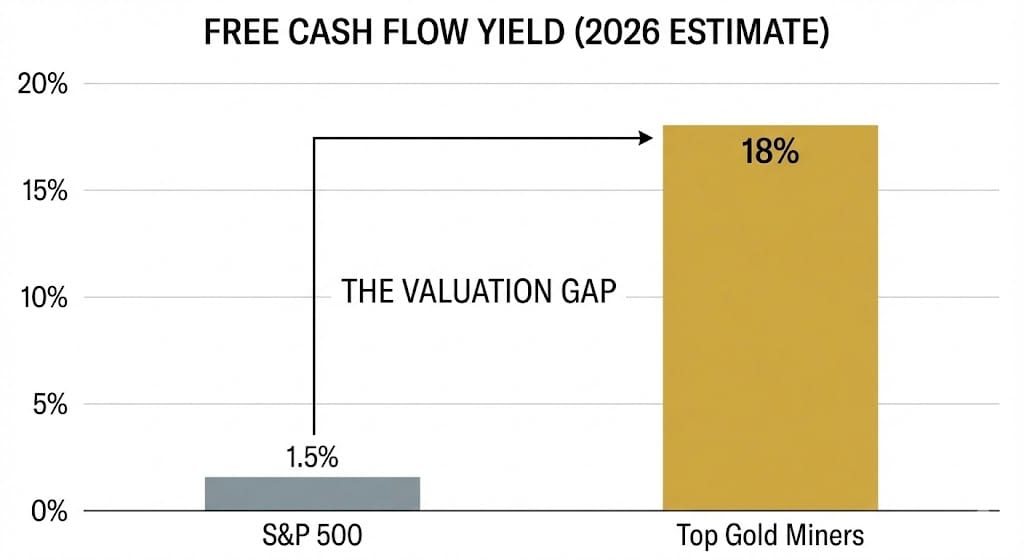

The real leverage isn’t in bullion.

It’s in gold companies that throw off cash while the market still prices them like optionality.

The Repricing Most Investors Aren’t Ready For

Markets are entering a phase where valuation narratives matter less than cash mechanics.

This is what changes when debt levels become structural instead of cyclical.

When government liabilities expand faster than growth, policy incentives shift:

Inflation becomes tolerated

Financial repression becomes normalized

Real assets regain strategic importance

That’s why governments are buying gold — not Bitcoin.

That’s why mining jurisdictions suddenly matter again.

And that’s why gold producers with clean balance sheets are being quietly re-rated by serious capital.

Buffett has always followed one rule:

Don’t predict policy. Position for incentives.

Right now, the incentives favor real assets with pricing power and cash flow — not promises.

Why This Isn’t About “Fear”

This isn’t a crisis trade. It’s a cycle trade.

Gold investing has always been about timing. You only want to own it during one specific phase of the macro cycle. That phase is now.

Not because the world is ending —

but because governments are adapting.

And adaptation always has winners.

One Thought Before Buffett Files His Next 13F

When Buffett finally deploys this cash, it won’t be obvious. It never is.

By the time headlines connect the dots, the repricing is already underway.

The opportunity isn’t in guessing what Buffett will do.

It’s in understanding why the math now points where it does.

Buffett’s Next Big Gold Bet Could Be Here

by Golden Portfolio

How was this edition?

Warren Blake

Editor-in-Chief, Smart Trade Insights