Autonomous driving has quietly crossed a line that matters to markets: cars are now moving through public space with no one inside, and the debate has shifted from engineering prowess to who bears the risk when something goes wrong. For Tesla, the latest robotaxi trials in Texas mark that transition from supervised experiment to unsupervised economic and legal event.

Texas Gives the Green Light: Unsupervised at Scale

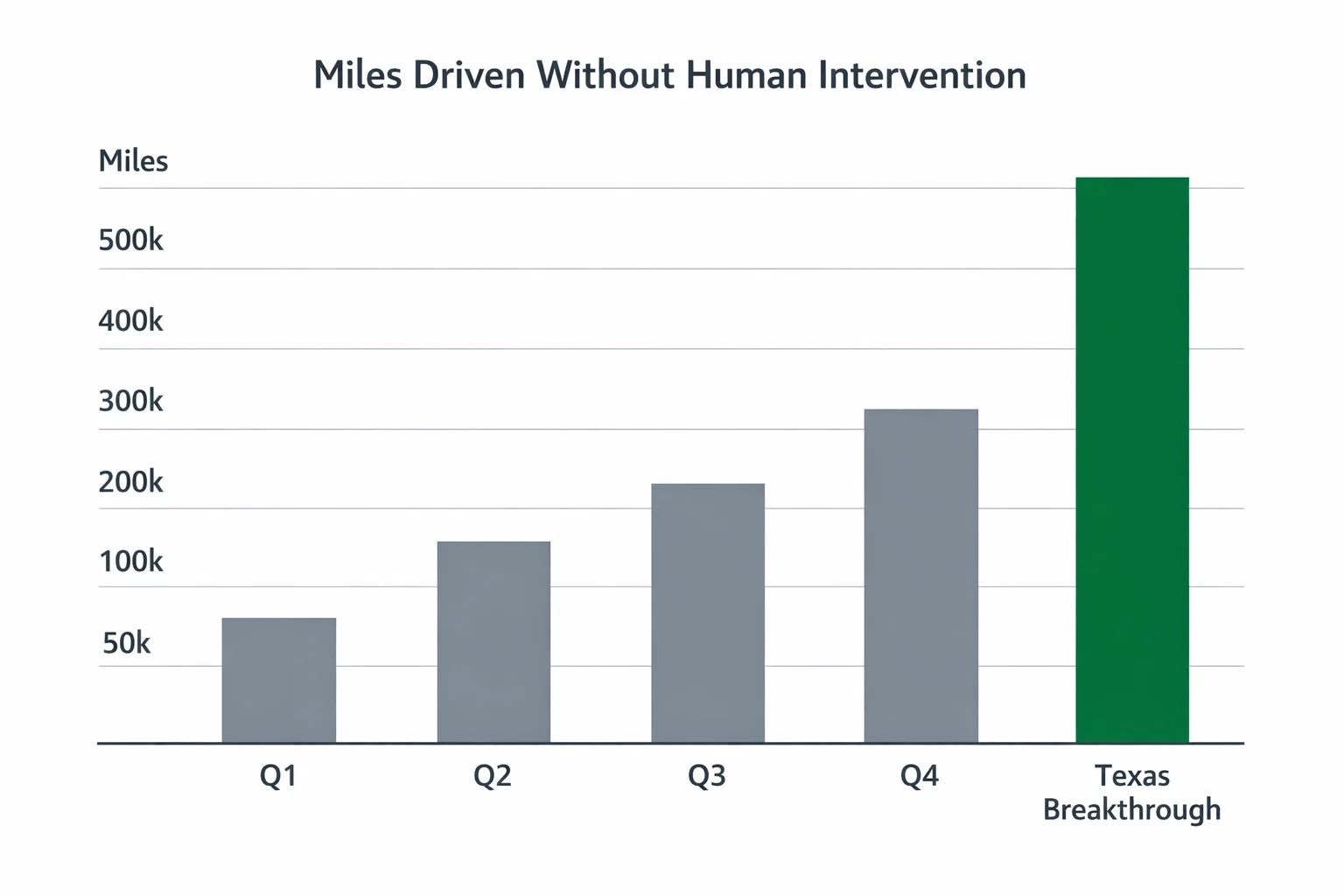

Reuters reports that Tesla shares hit their highest level in nearly a year after Elon Musk confirmed the company is testing robotaxis in Austin without any human safety monitors onboard. The move follows earlier trials where modified Model Y vehicles carried paying customers within a geofenced area, initially with a human “safety monitor” present, before shifting to runs with no occupants in the car. That step from someone in the passenger seat to nobody at all is an inflection point because responsibility for the driving task moves more clearly from the human to the system and, by extension, the manufacturer.

Public sightings underline that this is not just a lab exercise. Automotive outlets have documented Tesla-branded robotaxis circulating on Austin streets with no one visible inside, with Musk publicly confirming that testing “with no occupants in the vehicle” is underway. Texas’ relatively permissive rules for autonomous vehicles give Tesla room to conduct these trials, effectively turning parts of Austin into a live test bed for unsupervised driving at scale.

California Flashes Red: The Regulatory Pushback

The regulatory backdrop tells a different story about how fast the law is prepared to move. In California, the Department of Motor Vehicles has warned that Tesla could face a temporary suspension of its license to sell vehicles in the state unless it changes marketing language around “Autopilot” and “Full Self-Driving,” which regulators say has been deceptive by implying fully autonomous capability. An administrative law judge backed the view that Tesla’s advertising overstated what its driver-assistance systems can do, prompting the DMV to give the company a deadline to clarify or remove disputed phrasing before enforcing a 30‑day sales suspension.

The New Risk: When the Car Becomes the Driver

For investors, that combination of technical progress and regulatory pushback reframes autonomy as a liability and insurance question. As vehicles operate with no one inside, accident responsibility will increasingly be contested between drivers, manufacturers, software developers, and insurers, with case law likely to evolve jurisdiction by jurisdiction. That uncertainty can influence insurance pricing, warranty provisions, and the size of reserves companies may need to hold against potential claims, feeding back into margins and valuation multiples.

If a robotaxi hits a pedestrian at low speed, the question isn’t ‘who was driving’ — it’s whose balance sheet absorbs the claim.

Regulatory approval and deployment timelines also become harder to model. Texas may allow rapid deployment of unmanned robotaxis, but California is signaling that marketing and safety assurances will be scrutinized closely, and other states are watching both experiments. That creates a patchwork in which capital must be allocated state by state, and where a setback in one major market could slow nationwide rollout even if the technology continues to improve.

A Clearer Brew Ahead

The capital risk is straightforward: Tesla is steering significant investment and strategic focus toward self-driving and robotaxis, with the robotaxi narrative now central to its long‑term equity story. If regulators or courts constrain how quickly and broadly those services can operate, the payback period on that investment stretches, and investors will need to reassess how much of today’s valuation rests on autonomy-driven cash flows versus the core vehicle business.

Autonomy has therefore moved from a question of whether algorithms can keep a car between the lines to whether regulators, judges, and the public are prepared to accept machines driving alone among human road users. The next phase of this industry will be decided less by incremental improvements in perception or planning software and more by rulebooks, court rulings, and the level of trust that real-world deployments can earn over time.

How was this edition?

Warren Blake

Editor-in-Chief, Smart Trade Insights