For years, U.S. mining sat in the background. Cyclical. Unfashionable. Easy to ignore while capital chased growth stories elsewhere. That’s no longer the case.

Gold is trading near record levels after breaking $4,600 an ounce, and the move hasn’t faded. But the price itself isn’t the story. Prices move all the time. What matters is why this one is holding.

This Rally Has a Different Signature

This isn’t a retail rush. It isn’t ETF momentum.

Across early 2026, the buyers showing up in gold are institutions with long horizons and no urgency to trade in and out.

Central banks have been adding steadily.

Reserve managers are reweighting.

And the market is beginning to treat gold less like a hedge and more like a balance-sheet asset.

That shift matters. Central banks don’t chase trends. They move when the framework changes — and they position for years, not quarters.

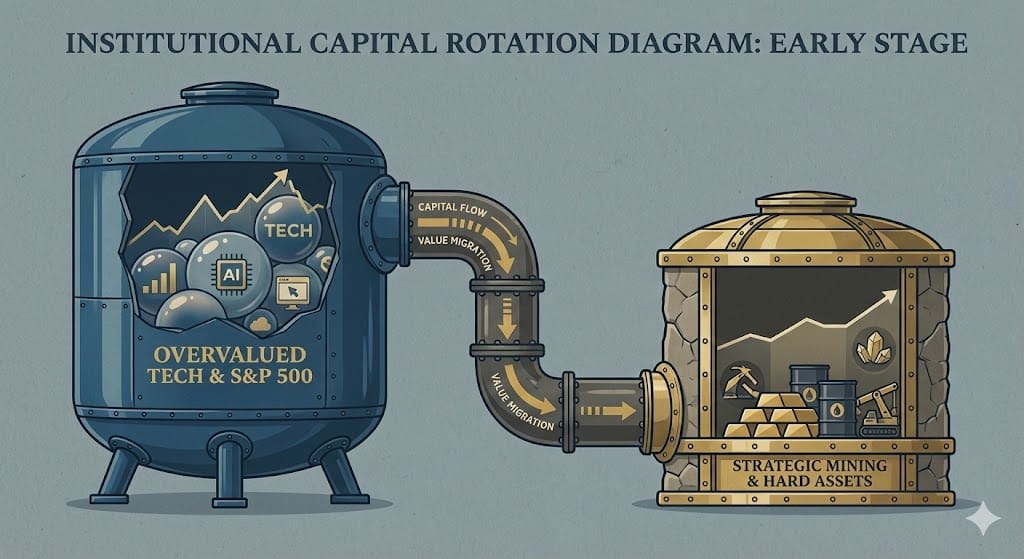

Capital Is Rotating, Not Panicking

While most attention stays locked on tech narratives and index performance, capital has started moving quietly toward real assets with cash flow and strategic relevance.

Large miners fit that profile.

Record gold prices expand margins immediately. At the same time, years of underinvestment mean supply can’t respond quickly. New projects take time, permits, and capital. That combination — strong pricing with constrained supply — tends to draw institutional money first.

Not into every miner. Into the ones large enough to absorb it.

Washington Has Taken Notice

Policy is beginning to align with the math. Recent appointments and permitting signals suggest the U.S. is treating mining less as a legacy industry and more as infrastructure.

Securing domestic supply chains — especially for critical materials — has become a priority that cuts across political lines. That alignment between capital and policy doesn’t happen often. When it does, it usually reshapes an industry quietly before the headlines catch up.

The Buffett Frame Still Holds

Historically, periods where equity valuations stretch far ahead of economic output tend to favor real assets over financial ones. That doesn’t mean markets collapse. It means capital reallocates.

Large investors don’t announce those shifts in advance. They wait. Filings appear later. By the time positions become visible, the early window has usually closed.

Bottom Line

Gold at record prices isn’t the headline. The headline is that mining is being reclassified — by capital and by policymakers — as strategic again.

Not speculative. Not cyclical. Strategic.

America’s mining revival won’t be loud. It won’t look like a boom. It will look methodical, capital-intensive, and patient.

Those are the conditions where large-cap miners with real cash flow tend to matter most — long before the broader market starts paying attention.

How was this edition?

Warren Blake

Editor-in-Chief, Smart Trade Insights