The End of 2025 Feels Quiet — But It Isn’t

The final days of 2025 look calm on the surface. Indexes are near highs. Volatility gauges are muted. Trading desks are thinning out for the holidays.

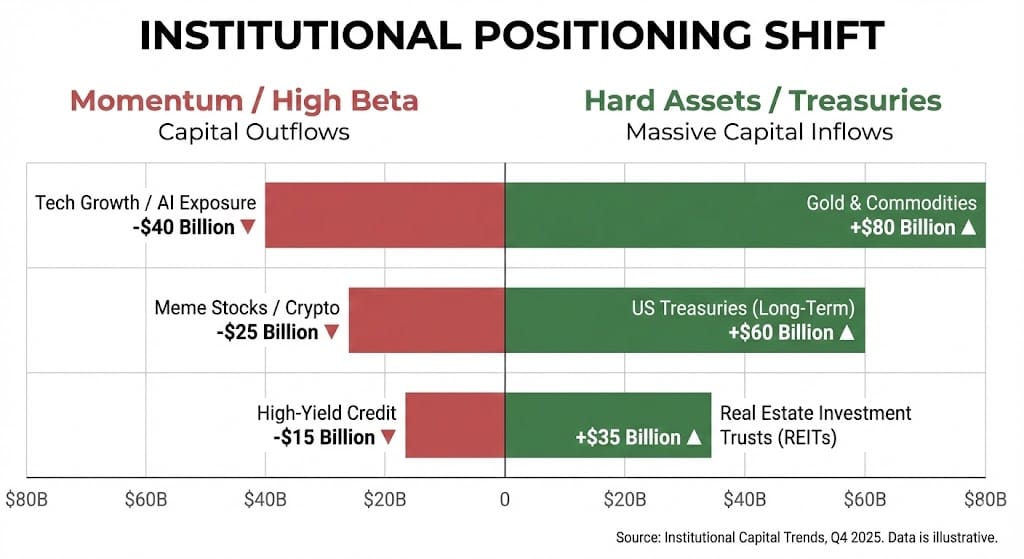

But underneath that stillness, positioning is changing — not loudly, not in headlines, but in structure.

Over the past several sessions, three markets that don’t usually move together started sending the same signal:

Precious metals surged, then sharply pulled back.

Treasuries slipped into a fragile holding pattern.

Real assets quietly outperformed narrative-driven trades.

This isn’t noise. It’s capital adjusting to a new regime.

Why Traditional Trades Are Losing Their Edge

End-of-year markets expose a truth most traders prefer to ignore: Complex strategies break down when liquidity disappears.

In thin conditions, markets don’t reward clever forecasts. They reward timing, structure, and repeatability.

That’s why so many traders finished 2025 frustrated:

Momentum faded without warning.

Breakouts failed without volume.

“Safe” correlations stopped working.

The problem isn’t skill. It’s that the environment changed.

When Markets Get Quiet, Patterns Get Loud

Historically, the most reliable edges don’t appear during hype cycles. They appear when volume is thin and when institutions step back.

This is when short, repeatable windows outperform long, complex trades.

That’s why professionals right now stop asking “what will happen?” and start asking something else entirely: “Where is the repeatable execution window?”

Why This Matters Going Into 2026

As 2025 closes, markets are shifting away from prediction and toward execution efficiency.

In uncertain environments:

Speed beats conviction.

Structure beats opinion.

Simplicity beats complexity.

That’s why the most resilient traders right now aren’t chasing themes. They’re focusing on short time windows and signals that don’t care about headlines.

One Thought Before the Calendar Turns

The biggest mistake traders make is assuming opportunity looks obvious. It doesn’t. It looks boring. Quiet. Uneventful. Until it isn’t.

Those who enter 2026 with structured, repeatable edges won’t need predictions. They’ll already be positioned.

This 1-Hour Window Is Quietly Funding Retirements

by Base Camp Trading

How was this edition?

Warren Blake

Editor-in-Chief, Smart Trade Insights