The Architecture Is Finished. The Software Comes Next

The digital dollar didn’t show up with a press conference or a rollout date. It showed up as infrastructure.

While the public debate stayed focused on inflation, rates, and politics, the Federal Reserve quietly launched FedNow — a 24/7 instant-payment rail now live across the U.S. banking system.

Officially, it’s about speed and convenience. In practice, it changes how money moves, settles, and can be shaped.

What FedNow Actually Is — and Why It Matters

FedNow is not a central bank digital currency (CBDC). The Fed has been clear on that. A true CBDC would require Congressional approval, and no such authorization exists today.

But FedNow solves something far more difficult than politics: the operating system.

Instant settlement.

Always-on availability.

Central coordination across banks.

Once that hardware exists, the software running on it becomes a policy choice — not a technical barrier. That distinction is subtle, but important.

From Speed to Programmability

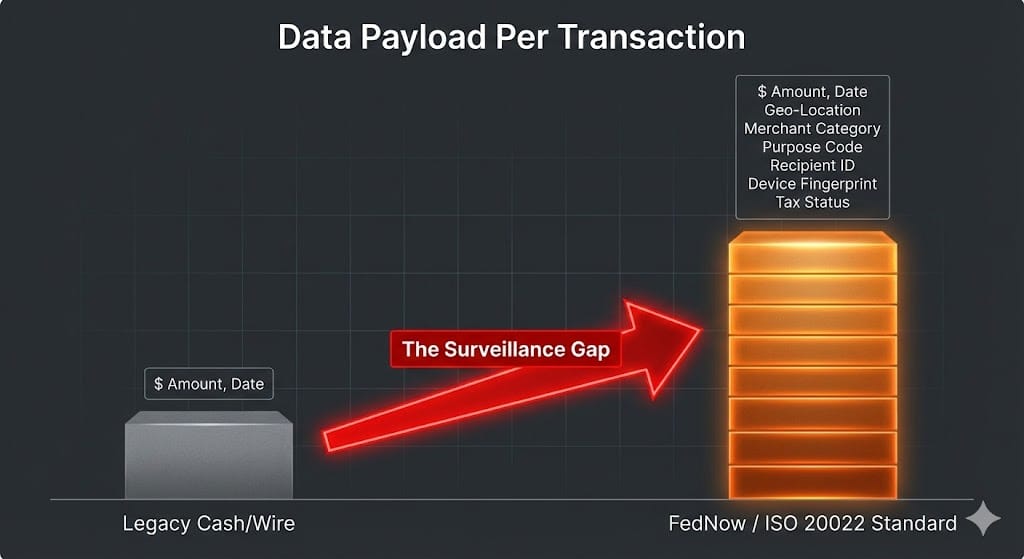

When payments settle instantly and digitally, new capabilities emerge:

Transactions can be tracked in real time.

Funds can be restricted by category or location.

Access can be paused, delayed, or conditioned.

This isn’t speculation. It’s how programmable systems work.

Whether those tools are used lightly or aggressively isn’t a technology question. It’s a governance one. And history suggests governance tends to expand once systems are in place.

The Global Context Is Hard to Ignore

Around the world, more than a hundred countries are exploring or piloting digital currencies. The U.S. has taken a slower, more cautious path. Publicly, policymakers emphasize privacy and restraint. Privately, infrastructure keeps advancing.

As tracked by the Atlantic Council, the global direction of travel is clear: payments are becoming faster, more digital, and more integrated with state oversight.

The question is no longer if these systems exist. It’s how optional they remain.

Why Opting Out Gets Harder Over Time

Digital systems scale quietly. As adoption spreads:

Cash becomes less accepted.

Alternatives feel less convenient.

Opting out starts to look impractical.

Choice isn’t removed overnight. It erodes. That’s how infrastructure locks in — not through force, but through default.

Bottom Line

FedNow didn’t create a digital dollar. It built the network a digital dollar would run on.

The system is already live. The debate has largely moved on. And once financial architecture becomes ubiquitous, reversing it is rare.

This isn’t about panic or conspiracy. It’s about understanding what’s already been built — and recognizing that financial flexibility is easiest to preserve before digital systems become the default, not after.

How was this edition?

Warren Blake

Editor-in-Chief, Smart Trade Insights